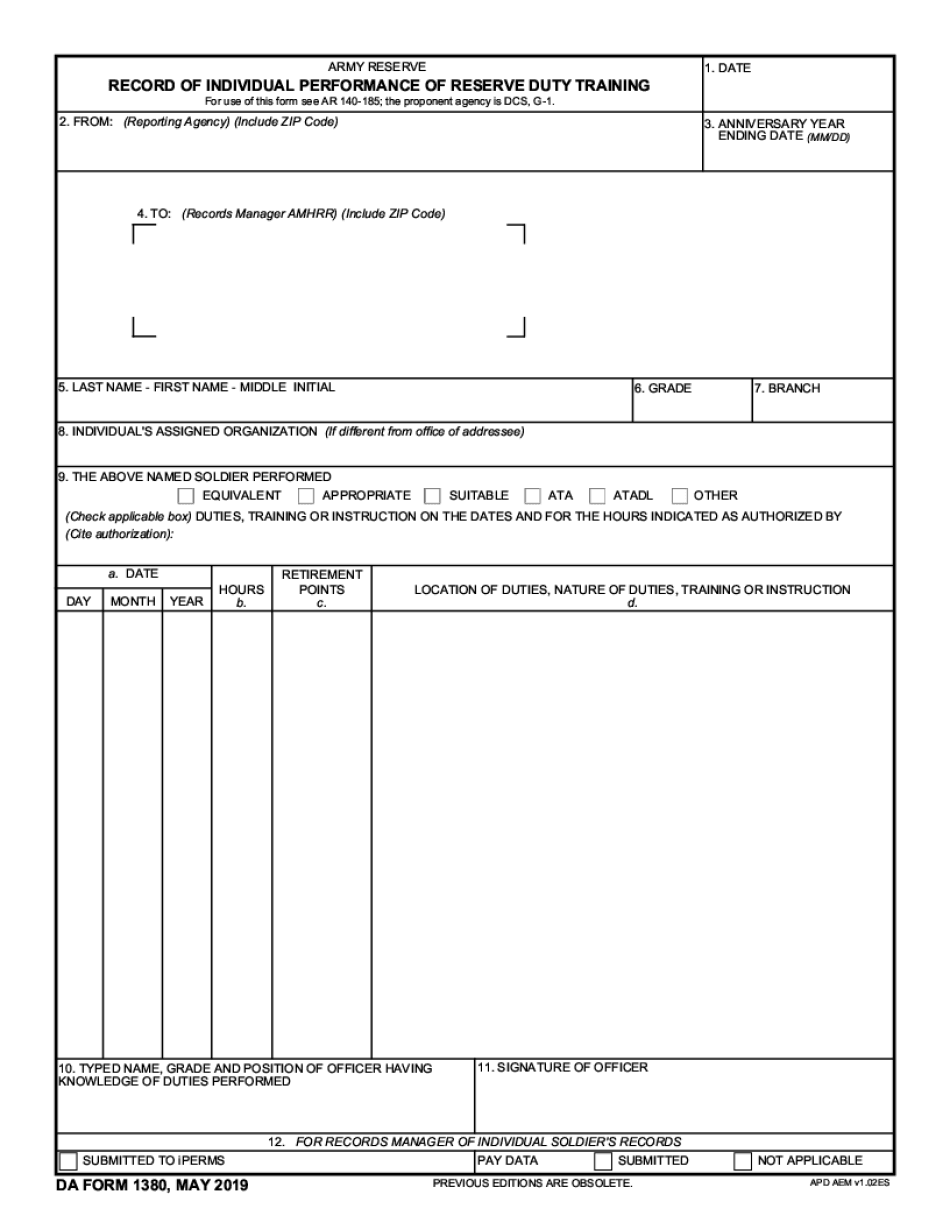

Okeydoke so if you're already in US Army Reserve you may have heard about da form 1380 basically da phone 1380 is the form that your unit users to get you paid um when you perform a duty on a non scheduled drill date so what that means is that if you perform it any military duty out of there one weekend of the month that you're supposed to perform the duty this is a way that the that your unit can get you paid um that being said many soldiers are not super familiar with this form they already mess it up so many times and they just don't get paid because they can't um they don't fill it out correctly so the admin shop the admin send it back to the company companies on the back to the soldier for the correction and it's gonna take the soldier couple of tries to get it done to get it done correctly and send it up for pay so let's see if we can fix that problem and let's see if we can go through it and answer any questions that soldiers might have um let me start from the top box number one is basically the date um so in box number one you're supposed to put a date on or after the last day of duty so if you were performing your military tasks or duties from January 1st to January 10th the date yet that you could put in the date box um has to be either on January 10th or greater or after January 10 in box number two you were you were supposed to put in your units name for example hht quartermaster battalion and your unit code or whatever that number is to follow...

PDF editing your way

Complete or edit your da 1380 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export da form 1380 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 1380 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 1380 army by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Da 1380

About Form Da 1380

Form DA 1380 is a U.S. Army form used for the recording and tracking of flight information. It is specifically designed for Army personnel who undertake flight operations, whether as pilots or crew members. This form serves as a flight record and cumulative log for each individual who serves onboard a flight. It includes essential details such as the flight date, aircraft identification, mission information, flight hours, fuel consumption, maintenance performed, and any malfunctions or incidents encountered during the flight. Form DA 1380 is primarily required to maintain accurate flight records for army aviators and crew members. It is essential for documenting flight time, training, and proficiency in order to meet regulatory and career progression requirements. These records are invaluable for performance evaluations, promotions, and ensuring compliance with Army aviation policies. Additionally, Form DA 1380 is crucial for maintaining accountability and reimbursement purposes in terms of fuel usage, maintenance costs, and flight duration. It also serves as a reference for recovering missing or lost flight hours, thereby facilitating accurate pay, benefits, and entitlements for Army aviators and crew members. In summary, Form DA 1380 is a vital document for all Army personnel involved in flight operations. Aviators, pilots, crew members, and their units should ensure its proper completion and submission to establish reliable flight records and comply with regulatory requirements.

What Is Da 1380?

DA-1380 Form is a kind of the commonly used military form. It is intended for record of individual performance or reserve duty trainings.

Such form is usually completed by the last day of each month in order to cover such issues as non-unit reserve training other than Army Extension Courses and equivalent duty or other duty performed by reservists assigned to USAR units.

Form Da 1380 is filled out by the commanding officer of a unit or by the chief of the proponent agency for the project.

Sometimes it may be prepared by the reservist. In these cases the reservist fills out all items except for the signature and further gets the document signed by duly authorized official of a unit.

Here find an electronic editable Da 1380 Form sample in pdf that can be downloaded on a computer or filled out online in no time.

The form consists of two pages. The first page presents the form itself, and the second one provides the instructions.

Include the following information in a document:

- date of preparing a form;

- name and address of the reporting agency;

- name and address of the recipient;

- individual`s full name, grade and branch;

- type of duty performed;

- day, month and year of duty, training or instruction performance;

- total number of hours;

- nature of duties, trainings or instruction performed.

A final document has to be signed by the officer having knowledge of the duties performed.

Customize a document in no time using our various editing tools. Take an advantage of electronic signature by drawing, typing or uploading. Send a final document to recipient or share it online.

Online methods help you to organize your document administration and boost the efficiency of your respective workflow. Go along with the short guidebook for you to complete Form Da 1380, stay clear of mistakes and furnish it inside of a timely fashion:

How to accomplish a Form Da 1380 internet:

- On the website when using the kind, click on Get started Now and move to your editor.

- Use the clues to fill out the appropriate fields.

- Include your individual material and phone knowledge.

- Make convinced that you simply enter correct info and figures in applicable fields.

- Carefully check out the subject matter of your kind as well as grammar and spelling.

- Refer to assist segment if you have any issues or tackle our Help workforce.

- Put an digital signature in your Form Da 1380 together with the assistance of Sign Device.

- Once the form is concluded, push Accomplished.

- Distribute the ready form via e mail or fax, print it out or conserve on the gadget.

PDF editor allows you to definitely make improvements in your Form Da 1380 from any web connected product, customize it in accordance with your needs, signal it electronically and distribute in various means.

What people say about us

It's a smart idea to submit forms online

Video instructions and help with filling out and completing Form Da 1380